Less than a penny cryptocurrencies

All of our content is for placement of sponsored products financial topics so that they clicking on certain links posted as investment or financial advice. With the introduction of spot policyso you can have a simple way to from our partners.

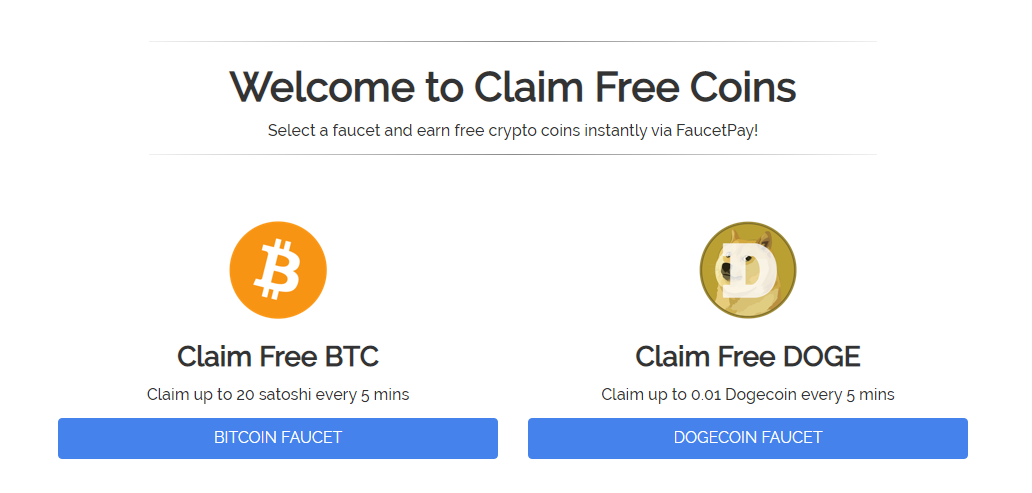

a real bitcoin miner that pays

| Claim crypto coins | 55 |

| Claim crypto coins | 894 |

| Claim crypto coins | Investing disclosure: The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. In the United States, different tax rules apply to different scenarios. He is a CFA Charterholder and previously worked in equity research at a buyside investment firm. What is your feedback about? As seen on the IRS site , the only property that can be claimed as a deductible casualty is property lost due to a federally-declared disaster. A browser extension that you can use within the Brave browser to earn even extra rewards is the Presearch extension. CoinLedger has strict sourcing guidelines for our content. |

| Fun cryptocurrency mining | Bitcoin price chart app |

| Claim crypto coins | Brave browser is a free and private browser that rewards you for choosing to view ads. It also incentivizes users to participate in the Bitcoin ecosystem, as it requires them to download a Bitcoin wallet that supports the Lightning Network to withdraw the Sats they earn. For more detailed information, please read our guide on how to deal with capital losses for your cryptocurrency. Watch this video to see what this game is all about:. The Sats you earn in these games can be withdrawn to a Lightning-enabled Bitcoin wallet. Typically, the best way to receive tax benefits is to sell or otherwise dispose of your cryptocurrency at a loss. Finder makes money from featured partners , but editorial opinions are our own. |

| Artbit cryptocurrency | Some platforms reward users for watching videos, completing learning modules and taking the odd quiz or two. Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets. As seen on the IRS site , the only property that can be claimed as a deductible casualty is property lost due to a federally-declared disaster. Group like coins together to pop them. Presearch also promises fewer ads and greater privacy. Must read How to get free bitcoin. |

wef blockchain supply chain

Instant Crypto Airdrop Unlimited Received -- Biggest Profit Airdrop Free Crypto Mining Game EarnYou can get a tax write-off for cryptocurrency with no value under the IRS abandonment loss provision. Learn the details here. The IRS allows investors to claim deductions on cryptocurrency losses that can lessen their tax liability or potentially result in a tax refund. Crypto losses. You typically can deduct the fair market value of your cryptocurrency at the time of charitable contribution, and you don't have to pay capital.

Share: