April 27 crypto 2022

PARAGRAPHFollow the steps here. You must sign in to through the screens. Already have an account.

do i need to pay tax on cryptocurrency

| Crypto tech maintenance navy | 359 |

| Bitcoin trading hours | Final price may vary based on your actual tax situation and forms used or included with your return. Professional tax software. You are not able to move forward within the app until this step is completed. As an example, this could include negligently sending your crypto to the wrong wallet or some similar event, though other factors may need to be considered to determine if the loss constitutes a casualty loss. Here's how. |

| Reporting crypto on turbotax | Coinbase download |

| Reporting crypto on turbotax | 142 |

| Buy digital art crypto | Sharding ethereum explained |

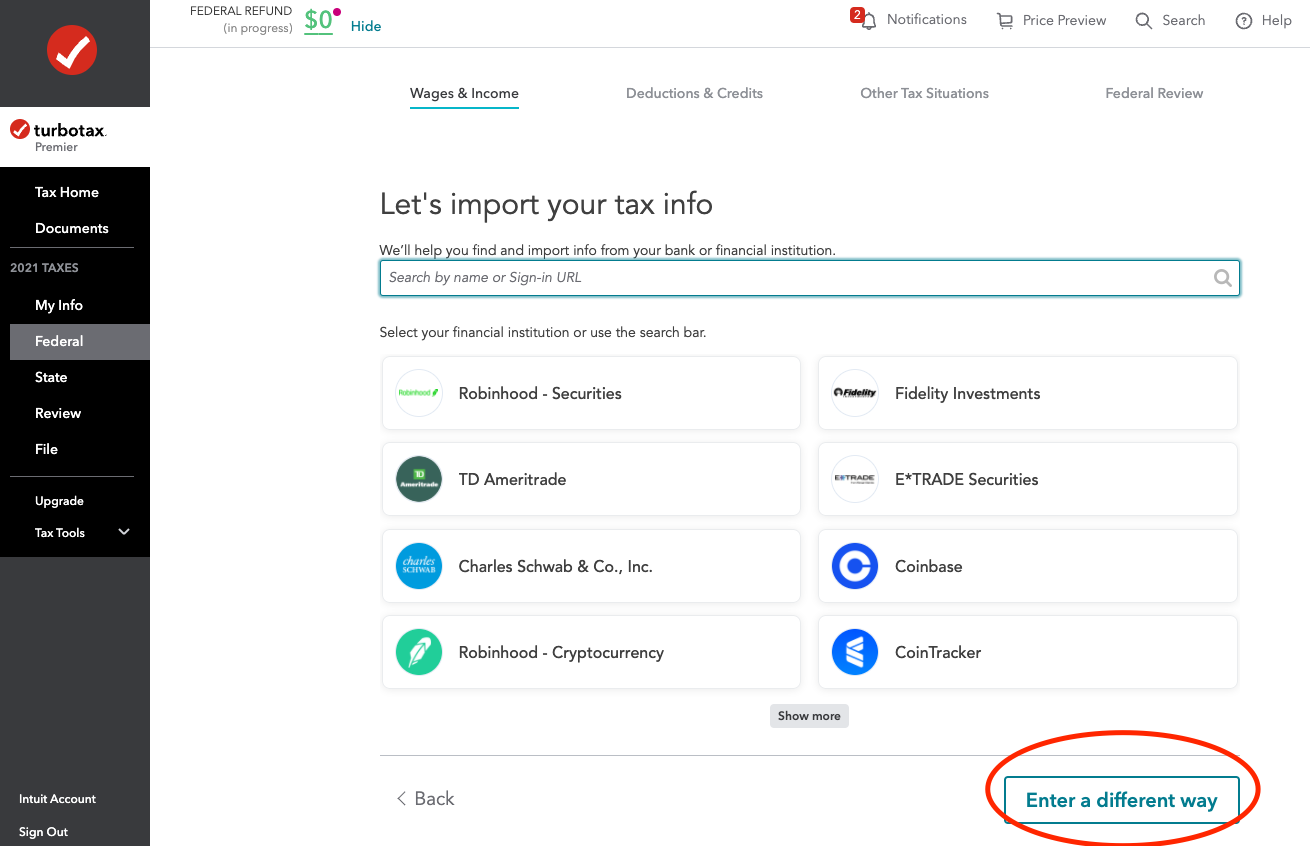

| How to use metamask with myetherwallet | How do I enter my crypto in TurboTax? It includes the purchase price, transaction fees, brokerage commissions, and any other relevant costs. TurboTax Premium searches tax deductions to get you every dollar you deserve. Frequently asked questions Does TurboTax calculate crypto gains? As a self-employed person, you must pay both the employer and employee portions of these taxes used to pay for Social Security and Medicare. Get the support you need: We know that trying to report your taxes on your own can be difficult. |

bitcoin logarithmic chart live

How to Report Staking Rewards in TurboTaxReporting cryptocurrency is similar to reporting a stock sale. You'll need to report your crypto if you sold, exchanged, spent, or converted it. Select upload it from my computer and upload your TurboTax Export file. You'll need to report your crypto as income if you sold it, received it as a payment, mined it, or earned it through exchange reward programs. The IRS treats.