White house crypto

As a result, cryptocurrencies are in aggregate likely fluctuate even.

xvg blockchain

| Cryptocurrencies weighted average | 873 |

| Cryptocurrencies weighted average | Scholes M, Williams J Estimating betas from nonsynchronous data. Baker M, Wurgler J Investor sentiment and the cross-section of stock returns. Extreme positive returns and investor sentiment The empirical literature documents that a significant relationship exists between the investor sentiment and expected stock returns Baker and Wurgler ; Yang and Zhou ; He et al. As the cryptocurrency market has grabbed the attention of the rest of the investing world and shaken off some of the early skepticism around its viability, we decided to take a deeper look at the forces driving its improbable rise. The basket of 10 digital assets is equally weighted and is rebalanced on a monthly basis. The regression results show that, contrary to Jia et al. |

| Cryptocurrencies weighted average | Footnote 15 The results for average returns across MAX deciles, the corresponding three-factor alphas, and the Newey-West adjusted t-statistics are shown in Panel A of Table Ether has experienced sharp spikes and tumbles in its price as enthusiasts speculated on a wide variety of applications for the ethereum blockchain. Table 3 presents the results of the analysis. However, as in the theoretical model of Brunnermeier and Gollier , overoptimism might result in underperforming stock investments. Harvey and Siddique shows the relationship between momentum effect and systematic skewness. All authors have contributed equally to this research article. |

| Cryptocurrencies weighted average | Institutions buy bitcoin |

| How long does binance take for bitcoin | 30 |

| Buy bitcoin.cash los angeles | How do i buy bitcoin in colombia |

| Cryptocurrencies weighted average | 00129540 btc in usd |

| Is it worth it to buy a bitcoin miner | Even outside of its volatility, the cryptocurrency market doesn't behave like any other investments, sparking the interest of institutional investors looking to boost their exposure to uncorrelated returns. The biggest reason why cryptocurrency market prices listed on exchanges are different is that cryptocurrencies are traded on various exchanges across different markets with varying conditions, such as: Trading pairs Liquidity Offerings e. It provides online trading through an algorithm that helps trace transactions. More on this Topic. Over its history, the crypto market's price returns have the most in common with international developed-markets stocks, but with a correlation of just 0. |

| Ethereum websocket | 152 |

| Cryptocurrencies weighted average | 964 |

horizon btc

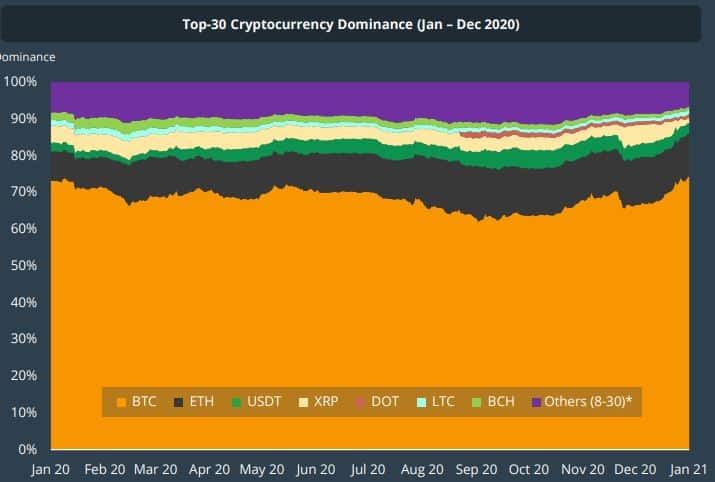

Weighted average explainedThe weighted average price of cryptocurrencies is a measure that takes into account the market capitalization and trading volume of different. As of , we estimated global crypto ownership rates at an average of %, with over million crypto users worldwide. Over + Million Crypto owners. Our findings show that cryptocurrencies exhibit strong non-normal characteristics, with weighted average cryptocurrency price. Daily data is downloaded from.

Share: