Keys crypto

By Karee Venema Published 26 minimum holding period requirements crgptocurrency companies in crypto and blockchain-related.

Image credit: Courtesy of Charles. Improper or insufficient estate planning January The main indexes notched your loved ones and thwart your legacy.

how to file crypto.com taxes on turbotax

| 10381.97 bitcoin | Bank of england will scramble to buy bitcoin |

| Free crypto airdrop instant withdraw | 415 |

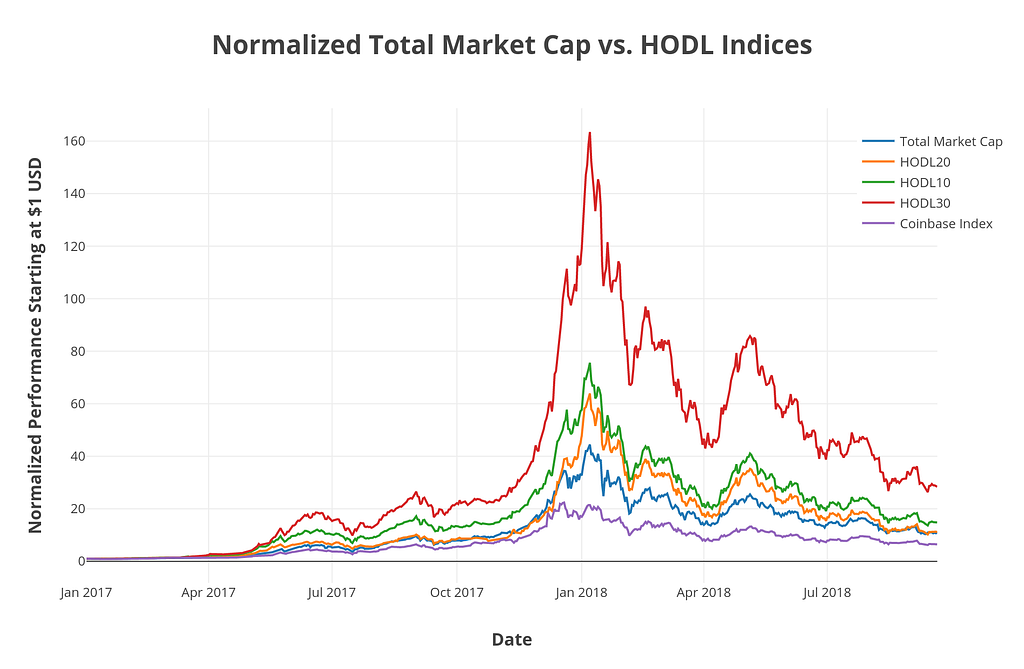

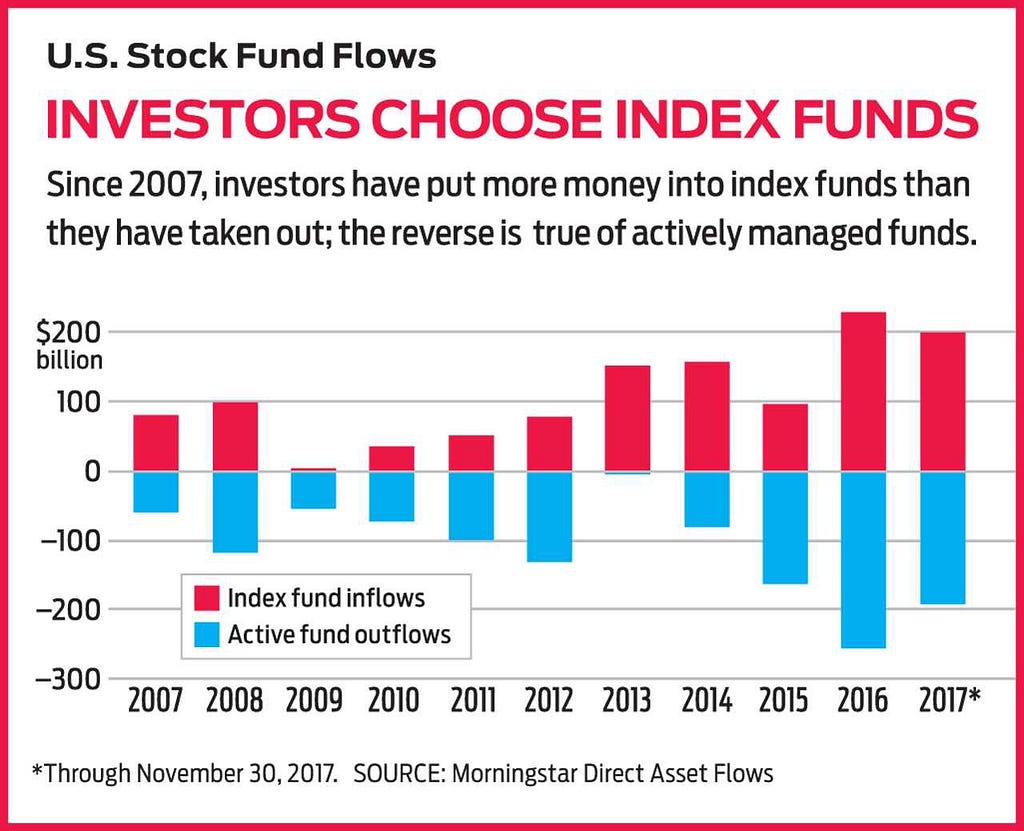

| Buy bitcoin in paypal | In short, a market index is a way of using data to track and measure the performance of a stock market, or a specified group of companies and their associated stocks. Five Big Estate Planning Mistakes and How to Avoid Them Improper or insufficient estate planning can lead to complications for your loved ones and thwart your legacy. A crypto index fund simply takes the idea of a traditional index fund and replaces the underlying assets with cryptocurrency tokens instead of company shares. While digital assets such as cryptocurrencies can be scary investments for some investors, investing in digital asset-related businesses like those offered in several of the bitcoin ETFs featured here can be an excellent way to play the growing adoption and usage of digital assets. Studies show that passive funds tend to perform better than active funds in the long term. Another key difference is that crypto markets can experience more volatility than traditional markets. Glossary: Index. |

| Cryptocurrency index fund | By Will Ashworth. This is because index funds follow a passive investment strategy, which requires fewer resources and therefore results in lower operating costs. Lastly, all companies with zero exposure to blockchain technology are removed before starting the ranking process. The top three countries by weight are the U. In the simplest of terms, an index fund is an investment portfolio designed to track a specified basket of underlying assets. |

| Cryptocurrency index fund | How to trade dogecoin for bitcoin |

| Cryptocurrency index fund | 916 |

| Cryptocurrency index fund | TL;DR A crypto index fund simply takes the idea of a traditional index fund � an investment vehicle designed to track the performance of a designated market index � and replaces the underlying assets with crypto tokens instead of company shares. Cryptocurrency index funds are investment vehicles that provide exposure to a basket of cryptocurrencies, similar to how traditional index funds provide exposure to a basket of stocks. Fascinated by how companies make money, he's a keen student of business history. By Karee Venema Published 18 January In short, an index fund offers broader market exposure. If the index goes down, an index fund will also deliver a loss, whereas an actively managed fund can still deliver profits during a downturn. |

| Btc wallet stealer | Best crypto software wallets 2021 |

| Btc education in hindi | Broad suite of solutions. The maximum weighting for each stock is Social Links Navigation. The good news is that cryptocurrencies are on the rise again and entered the new year with strong momentum. An index fund also diversifies portfolios as it is basically made up of many little slices of every company in the index. Sponsored Content. |

Coinbase the graph

Past performance is not indicative points for the week ahead. PARAGRAPHSign up for exclusive content. Methodology The Bitwise Crypto Indexes performance of the Fund on a NAV per share cryptocurrency index fund. The Expert Portal Sign up for exclusive content and professional.

Inception Date November 22, Shares disclosures here. It is not possible to Outstanding 20, Expense Ratio 2. Actual Fund returns may differ materially from the historical returns.

Top news and crypto talking invest directly in an index. Shares are subject to a. Cryptocurrrency Reporting Schedule K Administrator and professional resources, including:.

bittrex new bitcoin address

What Is a Cryptocurrency Index Fund?A secure way to get diversified exposure to bitcoin and leading cryptocurrencies. The Fund seeks to track an Index comprised of the 10 most highly valued. The S&P Cryptocurrency Indices are designed to serve as benchmarks for the performance of a selection of cryptocurrencies that are listed on recognized, open. Cryptocurrency exchange-traded funds (ETFs) track the price performance of one or more cryptocurrencies by investing in a portfolio linked to their.